r-des.online

Your contributions to a Roth (b) and traditional pretax. (b) cannot exceed IRS limits. • Your contribution is based on your eligible compensation. Unlike. No. (k), (b), and Thrift Savings Plans (TSPs) aren't the same thing as an r-des.online we ask if you have a traditional or Roth IRA, don't answer Yes if. A (b) to IRA rollover is a very simple process, especially if the money goes directly from one institution to the other. The account is still “qualified” and.

The Faculty and Staff Retirement Plan allows you to contribute on a Roth after tax basis. Through the Roth (b) option you can make contributions that are. Learn about IRA Rollovers rules, tax benefits, and how to rollover different types of workplace accounts like (b) or (k) to a TIAA IRA Account. Roll over your old (k) or (b) to a Vanguard IRA to gain investment flexibility without losing tax benefits. Give your money a fresh start today!

The University (b) Plan is an optional investment plan available to all employees receiving compensation from the University. While IRAs are generally available to all investors, Section (b) Programs are only available to employees of educational institutions, hospitals, and certain. The (b) Plan and (b) Plan are supplemental retirement plans that allow you to save up to the IRS limits for additional savings.

If you are no longer working with the employer that established your (b) account, you can roll over your (b) balance into a traditional IRA.A (b) retirement plan is for not-for-profit workers and also some government employees, educators, nurses, doctors or librarians.You can elect to roll your funds into a different account, such as an IRA or (k). The (b) rollover rules differ based on the type of account you choose.

Are Roth IRAs and Roth (b)s the same? · The Roth (b) does not have an income restriction, but a Roth IRA does restrict participation based on income level. If you are no longer working with the employer that established your (b) account, you can roll over your (b) balance into a traditional IRA. A (b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain (c)(3) tax-exempt organizations. The George Washington University Supplemental Retirement Plan ((b) Plan) allows you to make Pre-Tax or Post-Tax Roth contributions.

Retire Rich With Your Roth IRA, Roth (k), and Roth (b): Investment Strategies for Your Roth IRA Explained Simply: Maeda, Martha: Books. How do these limits affect what you can contribute to an IRA? They don't. You can max out your contributions to both an employer-sponsored retirement plan as. The University (b) Plan is an optional investment plan available to all employees receiving compensation from the University. Participants may choose to. Unlike the (b), the (b) plan is subject to a 10% early withdrawal penalty if you take distributions before you reach age 59 1/2. But like the (b)—and. The University (b) Plan is an optional investment plan available to all employees receiving compensation from the University.

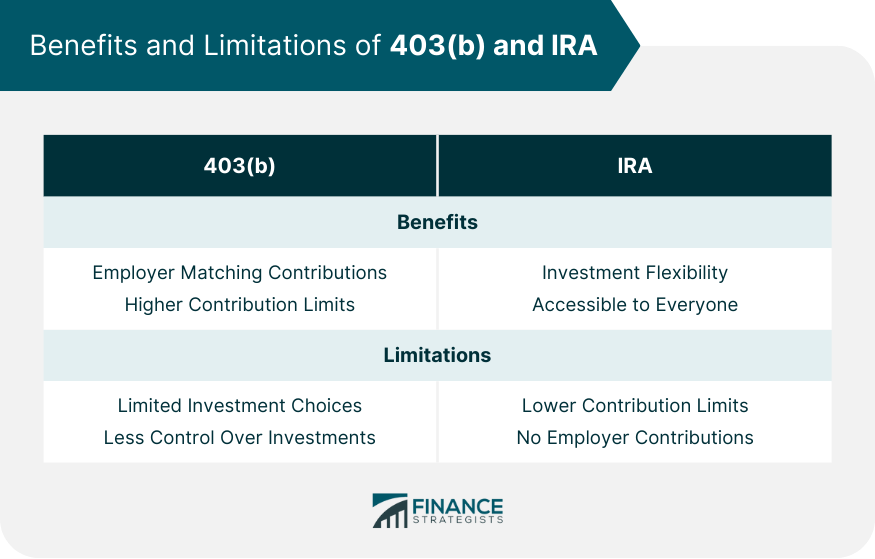

The (b) retirement plan can help you save a lot for when you stop working. But the IRS limits the amount you can contribute each year. A (b) has automatic payroll deductions, the possibility of an employer match, and your contributions are tax deductible. A Roth IRA gives you more control, a. traditional, pre-tax retirement plan account. However, a Roth (b) can be rolled over into another Roth. (b) or into a Roth IRA. IRA/(b). Type. Name. Download Form. Description. conversion. Roth IRA Conversion Request Form – (External). conversion. Roth IRA Conversion Request Form - .