r-des.online

Learn

Surge Protector Ratings And Reviews

See real customer reviews for Total Home Six Outlet Surge Protector at CVS pharmacy. See all reviews and shop with confidence! Continue Reading Progressive Industries Surge Protector SSPXL/50XL Review. I tested 4 faults: current overload, current excess, ground fault and voltage protection rating. APCs were the only ones to consistently pass all tests for any. GE 6-ft UltraPro 6-Outlet Joules Watt White Indoor Ac Surge Protector item number 2. it has a rating of with 37 reviews. Max Joule Surge Rating. Input Voltage. Outlet Type. Plug Type. Color. Metering Many of the best power strips, however, do have built-in surge protection. Read our detailed reviews & comparison of some of the best Surge Protectors to keep your electronic devices safe during a power surge. The Joule surge protection rating ensures that my devices are well-protected during electrical spikes and storms. Additionally, the overload protection. Main panel, subpanel and point of use applications up to KAIC fault current rating. Status LED with audible alarm. surge amps available in all. Customers frequently mention the great value and affordability of the 6-Outlet 1, Joules Surge Protector. They also appreciate its ease of use and the fact. See real customer reviews for Total Home Six Outlet Surge Protector at CVS pharmacy. See all reviews and shop with confidence! Continue Reading Progressive Industries Surge Protector SSPXL/50XL Review. I tested 4 faults: current overload, current excess, ground fault and voltage protection rating. APCs were the only ones to consistently pass all tests for any. GE 6-ft UltraPro 6-Outlet Joules Watt White Indoor Ac Surge Protector item number 2. it has a rating of with 37 reviews. Max Joule Surge Rating. Input Voltage. Outlet Type. Plug Type. Color. Metering Many of the best power strips, however, do have built-in surge protection. Read our detailed reviews & comparison of some of the best Surge Protectors to keep your electronic devices safe during a power surge. The Joule surge protection rating ensures that my devices are well-protected during electrical spikes and storms. Additionally, the overload protection. Main panel, subpanel and point of use applications up to KAIC fault current rating. Status LED with audible alarm. surge amps available in all. Customers frequently mention the great value and affordability of the 6-Outlet 1, Joules Surge Protector. They also appreciate its ease of use and the fact.

This surge protector gives me peace of mind when camping at sites with iffy electrical hook ups, also when at home it is good to know my camper is protected. Amount of protection you need. The amount of protection you need depends on the type of appliances and electronics you have in your home. · Voltage rating. We look at fire hazard, electrical shock hazard and even the personal injury hazard with things like sharp edges. Also look at the electrical rating — usually. Product Overview · At A Glance · Description · Weights & Dimensions · Specifications · Shipping & Returns · Ratings & Reviews. One of the comparison sites I checked out was thewirecutter(dot)com. As of 12/1/15, the Tripp-Lite Surge Protector TLPTEL is their highest recommended surge. Best surge protector for music equipment — Furman SS-6B PRO We have a lot of musicians here at Crutchfield, and many of them swear by Furman products. The. This is one of my personal favorites in the travel surge protector space. The device is rather compact and has 3 plug outlets and two USB outlets. The device. Very impressed with this nice 6 outlet surge protector. Nice thick quality plastic. Has a rotating plug which makes it easy to use. The protector also has a. This is a pretty nice surge protector. The cord is very heavy duty and thick. The plug is a little more substantial than I prefer for a flat plug, but it's far. If you place tremendous value in design, the Austere VII Series surge protector is the most attractive device in this category. With a brushed-aluminum. UL Voltage Protection Rating (VPR) is a measure of the surge protector's “let-through” voltage, which is the maximum voltage a surge protector will let. [This review was collected as part of a promotion.] I choose the Belkin Surge Protector because of their reputation for quality, and product warranty. A. The very popular power strip received over 21, ratings on Amazon, with 85% of consumers giving it a 5-star rating. One Beat also provides a month free-. Reviews · Rating Snapshot · Overall Rating · Review this Product · Average Customer Ratings · Customer Images and Videos · Filter Reviews · Best surge strip for almost. Customer reviews for GE General Purpose 3-Outlet Surge Protector, White. Go to ratings & reviews. GE General Purpose 3-Outlet Surge Protector, White. Energy absorption rating of at least joules; Protection for all three lines: hot, neutral, and ground. Quality power strip surge protectors typically cost. Best selling products: Best Power Strips & Surge Protectors · Square D HOMPSPD Homeline Surge Protector Device · Eaton CHSPT2SURGE Type 2 SPD Surge Protector -. Habitat Surge Protector + USB. star rating. 1 Review. Regular price $ Sale price $ Save $ Color — Summer Twilight. Customers praise the 6 Outlet Joules Surge Protector Strip with Color-Changing LED for its aesthetic design and functionality. They appreciate the color-.

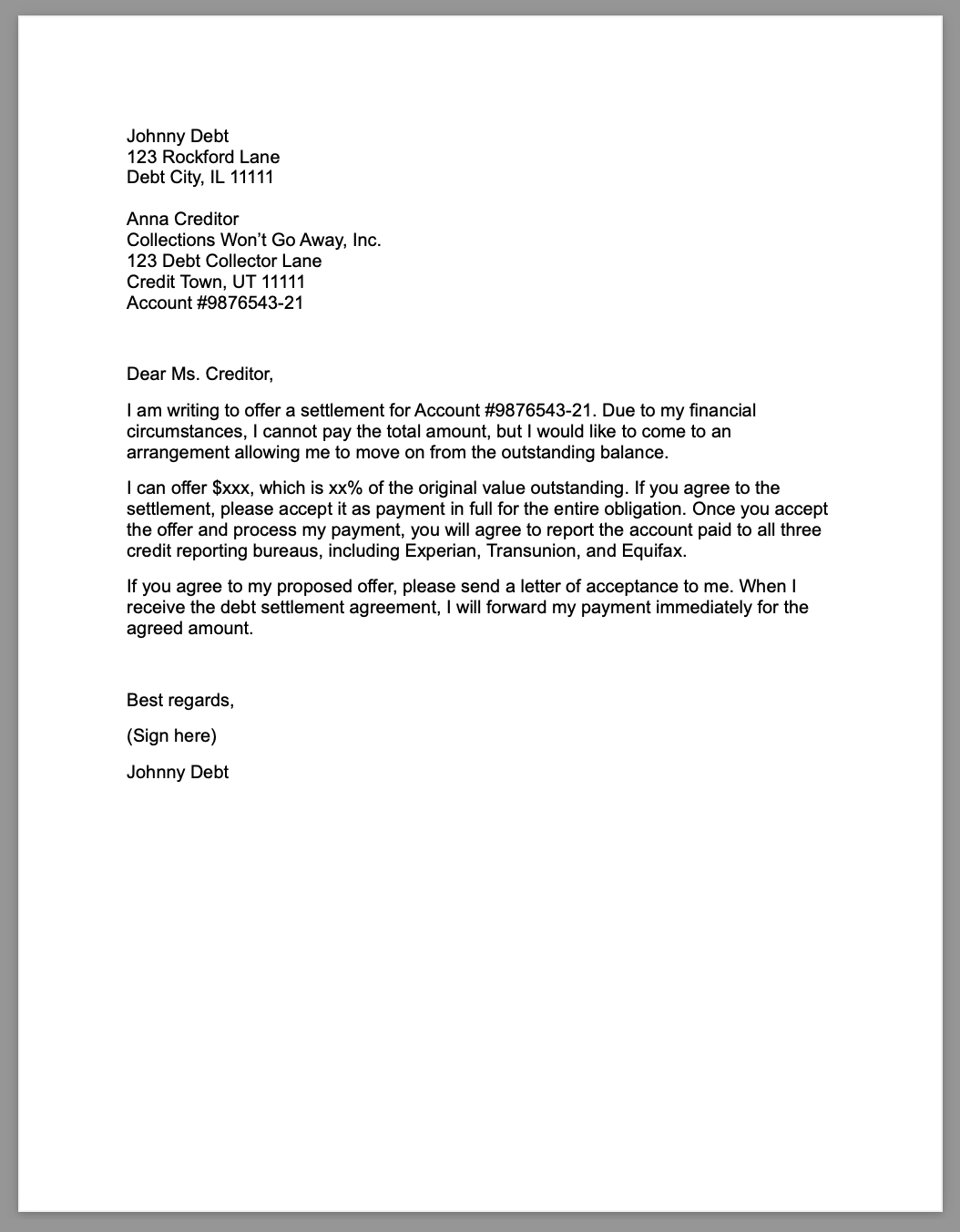

Loan Sent To Collections

Within five days after a debt collector first contacts you, it must send you a written notice, called a "validation notice," that tells you (1) the amount it. If you default on your private student loan, the lender may collect it itself, but it might also turn the debt over to a collection agency or even write off and. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment. mortgage debt but could be germane to the collection of student loan debt. A debt collector should send required notices to the attorney of record. The most common types of debt that go to collections are credit card balances and medical bills, but there are many other reasons why people go into debt. Rent. Payday Loan Businesses · Vehicle Registration · Lottery The annual filing form will be sent to your mailing address 60 days prior to the filing due date. Don't contact the collections, they'd have to note that they were able to reach you. Contact credit karma and say it was a mistake/payed off and they will. Once a loan has been charged off, it may be sent to a third-party collections agency at any time. If your loan has been placed with one of our third-party. If you default on your federal student loan, the entire balance of the loan (principal and interest) becomes immediately due. This is called acceleration. Within five days after a debt collector first contacts you, it must send you a written notice, called a "validation notice," that tells you (1) the amount it. If you default on your private student loan, the lender may collect it itself, but it might also turn the debt over to a collection agency or even write off and. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment. mortgage debt but could be germane to the collection of student loan debt. A debt collector should send required notices to the attorney of record. The most common types of debt that go to collections are credit card balances and medical bills, but there are many other reasons why people go into debt. Rent. Payday Loan Businesses · Vehicle Registration · Lottery The annual filing form will be sent to your mailing address 60 days prior to the filing due date. Don't contact the collections, they'd have to note that they were able to reach you. Contact credit karma and say it was a mistake/payed off and they will. Once a loan has been charged off, it may be sent to a third-party collections agency at any time. If your loan has been placed with one of our third-party. If you default on your federal student loan, the entire balance of the loan (principal and interest) becomes immediately due. This is called acceleration.

However, you will seldom be taken to court for a debt that is less than six months overdue. Creditors and collection agencies may also threaten to take you. If you owe a debt, act quickly — preferably before it's sent to a collection agency. Contact your creditor, explain your situation and try to create a payment. The debt may be completely fake, canceled, discharged, forgiven or beyond the period for collection. In any case, the scammer will use all sorts of techniques. Are you behind on your credit card payments, your home mortgage, a personal loan or other debt? If so, you may be contacted by the creditor or a debt collection. What To Know About Repaying Debts · talk to you by phone or in person about the debt · mail a letter or send an electronic communication about the debt, such as a. Don't contact the collections, they'd have to note that they were able to reach you. Contact credit karma and say it was a mistake/payed off and they will. If the creditor has not taken your house, car, or other property as collateral on a loan, then legally the creditor can only do three things: Stop doing. You can expect to hear from a collection agency when the original creditor transfers your debt. Professional debt collectors know that the earlier they contact. Using a loan to pay off collections can save you fees, interest, and damage to your credit score associated with collections debt. First, figure out what type. Loan Collections. Billing Statements. Billing Schedule Bills, also referred to as statements, are sent out around the 15th of. If you have past due debt that's been sent to collections, you may still be able to negotiate repayment directly with your lender. · Debt collectors are third-. What Does It Mean to Have a Loan Sent to Collection? Once your debt is sent to a collections agency, that agency will do everything they can to get you to pay. 1. In New York, a debt collector cannot collect or attempt to collect on a payday loan. Payday loans are illegal in New York. Within five days after a debt collector first contacts you, it must send you a written notice, called a "validation notice," that tells you (1) the amount it. Creditors can use that judgment to garnish wages and seize assets if you are not able to arrange a repayment plan with them. Collections Laws. Canadian debt. Collections show on your credit report, and outstanding collections will raise concerns for lenders. Charge-offs are debts that cannot be collected and are. debt collection services to federal agencies. We work with debtors based on their ability to pay. We send letters, receive and place telephone calls, refer. Step 1: Contact the Debtor · Step 2: Send a Demand Letter · Step 3: Consider Negotiation · Step 4: Hire a Collection Agency · Step 5: Provide Documentation · Step 6. The creditor you originally owed the money to may have sold your debt to a collection agency, which in turn may have sold it to another collection agency. A. A debt collector is a person or organization that recovers money owed on delinquent accounts. Creditors hire debt collectors when they are owed money by.

Best Travel Card For Beginners

12 best credit cards for travel. Winner: Best for general travel. Chase Sapphire Reserve. Best Travel Credit Cards in August · Best for Frequent Travelers: Chase Sapphire Reserve® · Best for Budget Travelers: Chase Sapphire Preferred® Card · Best. The Capital One Venture Rewards Credit Card is easily one of the top credit cards for travel reward beginners. This card also comes with an annual fee of $ The Best Travel Card For Beginners—Chase Sapphire Preferred® Card. A great travel credit card comes with great rewards, valuable perks and the opportunity to maximize your value overall. But while these are all important considerations, we've simplified travel credit cards into three easy categories: airline cards, hotel cards, and flexible. Start your journey by finding the best travel credit card from Chase. Compare travel rewards benefits and offers including dining perks, and new signup. Beginners Guide to Travel Insurance · Earn k Points in Your First Year 2) Capital One Venture X Rewards Credit Card. Best for premium travel perks. United Gateway℠ Card: Best feature: United Airlines travel rewards. Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. Delta SkyMiles® Blue. 12 best credit cards for travel. Winner: Best for general travel. Chase Sapphire Reserve. Best Travel Credit Cards in August · Best for Frequent Travelers: Chase Sapphire Reserve® · Best for Budget Travelers: Chase Sapphire Preferred® Card · Best. The Capital One Venture Rewards Credit Card is easily one of the top credit cards for travel reward beginners. This card also comes with an annual fee of $ The Best Travel Card For Beginners—Chase Sapphire Preferred® Card. A great travel credit card comes with great rewards, valuable perks and the opportunity to maximize your value overall. But while these are all important considerations, we've simplified travel credit cards into three easy categories: airline cards, hotel cards, and flexible. Start your journey by finding the best travel credit card from Chase. Compare travel rewards benefits and offers including dining perks, and new signup. Beginners Guide to Travel Insurance · Earn k Points in Your First Year 2) Capital One Venture X Rewards Credit Card. Best for premium travel perks. United Gateway℠ Card: Best feature: United Airlines travel rewards. Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. Delta SkyMiles® Blue.

The Capital One Venture X Rewards Credit Card offers rich rewards and travel perks, and unlike many other premium travel credit cards, the Venture X doesn't. American Express Gold Card · 4X points at restaurants worldwide, on up to $50K in purchases · 3X points on flights booked directly with airlines ; The Platinum. From flexible travel points to cruise rewards to vacation packages or air miles, we've got a travel or cruise line credit card that's right for you. Start. Capital One Venture X Rewards Credit Card. Best Travel Perks & Premium Benefits. CURRENT OFFER: Earn 75, bonus miles when you spend $4, on purchases. The Chase Sapphire Preferred® Card is my very favorite beginner travel rewards credit card and is one we've personally had and loved for years and years. Earn rewards and enjoy luxury perks with these travel credit cards. Chase Sapphire Preferred Card: Best Overall • Chase Freedom Unlimited: Best for No. Premium Travel Benefits + 75, Bonus Miles · Earn unlimited miles per dollar on every purchase · Earn unlimited miles per dollar on every purchase. Chase Sapphire Preferred: Best travel credit card for beginners. The Chase Sapphire Preferred is ideal for travelers because it includes many travel protections. Our reviews explore popular travel cards in depth, covering perks like airline miles, hotel upgrades, and travel insurance. Chase Sapphire Preferred® Card is what I consider an "easy to start" card and one I recommend to most newbie "points" travelers—with simple mile transfers and. Best Travel Credit Card Offers ; Overall #1 Travel Credit Card for Beginners: Chase Sapphire Preferred® Card (60, points) ; Best Stay-at-Home, Travel Later. Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $, on these purchases per. United Gateway℠ Card: Best feature: United Airlines travel rewards. Chase Freedom Unlimited®: Best feature: Flexible cash back rewards. Delta SkyMiles® Blue. The welcome bonus is worth at least $ in travel, the annual fee is reasonable, and the rewards (Chase Ultimate Rewards) are easy to earn and redeem. Chase. But the biggest reward for your effort typically comes from the sign-up bonus, when the bank might offer you 50, points for spending $3, on the card in. A travel credit card is a great choice if you're a frequent traveler or if you're planning a trip in the future. You can earn points on everyday purchases and. Best for Flexible Rewards: Capital One VentureOne Rewards Credit Card. Why we love this card: If you want to earn travel rewards points that transfer to airline. This card offers the best of any aspect of life! Travel, Rewards, Cashback! Everything is just so well explained and the customer service is just perfect. Will. 12 best credit cards for travel. Winner: Best for general travel. Chase Sapphire Reserve. The Chase Sapphire Preferred® Card is our top choice because of its amazing signup bonus, reasonable annual fee, and the amazing value of the points it earns.

Invest 25000 In Mutual Funds

$25, and over and this includes access to unlimited 1-on-1 coaching calls from Stocks, bonds, ETFs, mutual funds, CDs, options and fractional shares. These mutual fund sip calculators are designed to give potential investors an estimate on their mutual fund investments. However, the actual returns offered by. You are already past the point of just sticking it in a mutual fund. You need focused investment management, and that you will get from a fee-based manager. Some investments have third-party internal expenses. $5, is the account minimum for Fund accounts with mutual funds and ETFs. $25, is the account minimum. Investor A Shares—Purchased with varying initial sales charges, depending on the fund and investment amount, and provide up-front commissions and ongoing. These mutual fund sip calculators are designed to give potential investors an estimate on their mutual fund investments. However, the actual returns offered by. Divide your amount into 2 parts, and invest into L&T India Prudence Fund and Axis Long Term Equity fund. Here, I am suggesting Axis Long Term. investment options, including stocks, bonds, and mutual funds. We manage an account consisting of zero expense ratio Fidelity mutual funds for you. Minimums. If you are determined to invest your $25,, consider investing in less risky investments such as high-yield savings accounts, bonds, or CDs. These investments. $25, and over and this includes access to unlimited 1-on-1 coaching calls from Stocks, bonds, ETFs, mutual funds, CDs, options and fractional shares. These mutual fund sip calculators are designed to give potential investors an estimate on their mutual fund investments. However, the actual returns offered by. You are already past the point of just sticking it in a mutual fund. You need focused investment management, and that you will get from a fee-based manager. Some investments have third-party internal expenses. $5, is the account minimum for Fund accounts with mutual funds and ETFs. $25, is the account minimum. Investor A Shares—Purchased with varying initial sales charges, depending on the fund and investment amount, and provide up-front commissions and ongoing. These mutual fund sip calculators are designed to give potential investors an estimate on their mutual fund investments. However, the actual returns offered by. Divide your amount into 2 parts, and invest into L&T India Prudence Fund and Axis Long Term Equity fund. Here, I am suggesting Axis Long Term. investment options, including stocks, bonds, and mutual funds. We manage an account consisting of zero expense ratio Fidelity mutual funds for you. Minimums. If you are determined to invest your $25,, consider investing in less risky investments such as high-yield savings accounts, bonds, or CDs. These investments.

A mutual fund is a type of investment company, known as an open-end fund, that pools money from many investors and invests it based on specific investment. Making consistent investments over a number of years can be an effective strategy to accumulate wealth. Even small additions to your investment add up over. investments of $25,, which increase as the size of your investment Mutual funds typically offer multiple breakpoints, each at increasingly higher. Form , which is used to report Passive Foreign Investment Companies, including Foreign Mutual Funds. $25, if the person files single or separate. You can start investing in a mutual fund through a brokerage firm. If you want to maximize your investment, look for a broker with no transaction fee (a charge. Similarly, if you stay invested in the scheme for 15 years, the future amount of your investment will be Rs lakh, vis-a-vis an invested amount of Rs 9. Answer to: You invest $ in a stock-based mutual fund. This fund should earn (on average) 10% compounded annually over the life of the. Say, you start a SIP of ₹25, in a mutual fund A Systematic Investment Plan is simply a style of investment, whereas mutual funds are financial products. Systematic Investment Plan or SIP is a method of investing in mutual funds. You may invest a fixed amount regularly in a mutual fund scheme of your choice. You. Since you plan to invest Rs 25, per month through SIPs, you should select maximum 3 to 4 good equity funds for your portfolio. Given the current volatility. Risk tolerance depends on various factors such as age, investment horizon, income stability, and financial obligations. Selecting Suitable Funds: Large-Cap. A mutual fund is a financial instrument that pools the amount from several investors to make of corpus. The corpus is invested and maintained by a fund manager. Use this calculator to gain a better understanding of how different inputs can impact the rate of return on your investments. Mutual Funds are one of the easiest and most popular ways to invest your money to start building wealth. A Mutual Fund is a pool of money provided by individual. However, the selection of funds from different categories should be based on your risk taking appetite and the investment horizon. You have already mentioned. Systematic Investment Plan or SIP is a method of investing in mutual funds. You may invest a fixed amount regularly in a mutual fund scheme of your choice. You. In real life, investment returns such as the S&P, ETFs, mutual funds, and REITS are not usually fixed, so this is just an estimate. Bonds usually provide more. savings will grow over time. Add in any additional savings. In real life, investment returns such as the S&P, ETFs, mutual funds, and REITS are not usually. Total amount you will initially invest or have currently have invested toward your investment goal. investment funds and/or investment companies may charge.

Set Up A Blockchain

Discuss the implementation of Blockchain and cryptocurrencies. Understand main blockchain concepts like Proof-of-Work, mining, peer-to-peer connections, etc. How to build a blockchain with Rust Programming Language · Writing a Rust Blockchain · Top Rust Blockchains · Other Future Web3 Use Cases · Learn More About. Best Practices for Using a Private Blockchain · Choose a Consensus Algorithm · Use a Permissioned Network · Use Strong Encryption · Ensure Network Resilience. Blockchain has the potential to Practice resources Setting up in practice Running your practice Supporting your clients Regulation Practice technology. How to Create Own Blockchain Network · Step 1: Identify a Suitable Use-case · Step 2: Identify the Most Suitable Consensus Mechanism · Step 3: Identify the Most. How to build a blockchain app · Step 1: Clarify your idea · Step 2: Do competitor research · Step 3: Analyze your options · Step 4: Choose a platform · Step 5: Start. First, We will create a block, second, We will add the data (header and body) to it, third, We will hash the block, and last but not least We. In Bitcoin, your transaction is sent to a memory pool, where it is stored and queued until a miner picks it up. Once it is entered into a block and the block. To create a blockchain or any DLT, the most important thing is the consensus protocol. Typically you develop the theory and mathematical proof. Discuss the implementation of Blockchain and cryptocurrencies. Understand main blockchain concepts like Proof-of-Work, mining, peer-to-peer connections, etc. How to build a blockchain with Rust Programming Language · Writing a Rust Blockchain · Top Rust Blockchains · Other Future Web3 Use Cases · Learn More About. Best Practices for Using a Private Blockchain · Choose a Consensus Algorithm · Use a Permissioned Network · Use Strong Encryption · Ensure Network Resilience. Blockchain has the potential to Practice resources Setting up in practice Running your practice Supporting your clients Regulation Practice technology. How to Create Own Blockchain Network · Step 1: Identify a Suitable Use-case · Step 2: Identify the Most Suitable Consensus Mechanism · Step 3: Identify the Most. How to build a blockchain app · Step 1: Clarify your idea · Step 2: Do competitor research · Step 3: Analyze your options · Step 4: Choose a platform · Step 5: Start. First, We will create a block, second, We will add the data (header and body) to it, third, We will hash the block, and last but not least We. In Bitcoin, your transaction is sent to a memory pool, where it is stored and queued until a miner picks it up. Once it is entered into a block and the block. To create a blockchain or any DLT, the most important thing is the consensus protocol. Typically you develop the theory and mathematical proof.

There are several ways to build a blockchain network. They can be public, private, permissioned, or built by a consortium. Public blockchain networks. A public. Setting it up involves several steps, including creating proof of concept, selecting blockchain and its building and testing, network management, activation. These attempts at creating technology for decentralized money paved the path for Bitcoin, which in turn allowed for the popularization of a decentralized. How to Create a Blockchain Wallet? · Step 1: Choosing the Operating Language and Blockchain Network · Step 2: Build a User Interface for the Blockchain Wallet. This page provides an overview of how to create a Blockchain Node Engine node. Note: It takes about 30 minutes to create a node. Developing a Blockchain Network: Steps to take · Step 1: Identify a Suitable Use-case · Step 3 Finding the Best Platform · Step 4 Designing the. Fully managed service that makes it easy to create and manage scalable blockchain networks and distributed ledger technology. How to Create a Blockchain Wallet? · Step 1: Choosing the Operating Language and Blockchain Network · Step 2: Build a User Interface for the Blockchain Wallet. This guide outlines the step-by-step process to create and deploy a blockchain that aligns with your specific needs. Although there may be no magical strategy to build a successful blockchain company, understanding the potential blockchain has to offer is the key. 1. Creating Your Own Blockchain and Cryptocurrency You can write your own code to create a new blockchain that supports a native cryptocurrency. In this tutorial, you'll build and start a single node blockchain using the node template. The Substrate node template provides a working single-node. Let's explore how to create a blockchain app with our exhaustive guide. We've covered all the processes involved with major benefits and possible challenges. Build your blockchain app for iOS and Android with our no-code blockchain app builder. It's easy, fast and cost-effective to get your blockchain app. We'll cut through the hype and mystery, explain what blockchain is, and help you understand if your business could benefit from becoming a blockchain startup. Self-custody wallets · Download a wallet app. Popular options include Coinbase Wallet. · Create your account. Unlike a hosted wallet, you don't need to share. Conduct a feasibility study. Create a business case. Conceptualize the blockchain. Scope the project. Develop a Proof of Concept (optional). Design the. Blockchain can allow borrowers to make their credit reports more accurate and securely shareable. Credit reports can be issued as Verifiable Credentials and. But blockchain uses the three principles of cryptography, decentralization, and consensus to create a highly secure underlying software system that is nearly. This article explains how to create a private blockchain with examples. But before we dive deeper, let us touch upon the basics of blockchain.

Car Price Comparison App

Select up to three cars for a side-by-side comparison. Compare car specs, base MSRPs, safety features and new technology before you purchase a new vehicle. r-des.online gives you everything you need to research a new, certified (CPO) or used car, compare cars, find cars for sale and make a well-informed decision. We're. OOYYO - PRICE COMPARISON ENGINE for Used Cars More than 5,, CAR LISTINGS SAVE MONEY - with New AI (artificial intelligence) OOYYO SYSTEM. Compare up to three cars using our car comparison tool. Looking for a car but don't know where to start? Look no further! With our easy-to-use find vehicle and comparison tool, quickly find and compare cars that. I put together a simple spreadsheet to compare the price to mileage of cars. It's useful to me since I already know which car I'd like to buy, with only small. Compare SUV, truck, and car prices, mpg, car reviews, specs, rebates & incentives and more. Kelley Blue Book's car comparison tool will help you find the. TrueCar lets you control your car-buying journey. Shop new & used cars, sell your car, and find all the vehicle information you need with our research. Shopping for a new or used car or truck? Download the free r-des.online app and start exploring every possible car for every possible you. Select up to three cars for a side-by-side comparison. Compare car specs, base MSRPs, safety features and new technology before you purchase a new vehicle. r-des.online gives you everything you need to research a new, certified (CPO) or used car, compare cars, find cars for sale and make a well-informed decision. We're. OOYYO - PRICE COMPARISON ENGINE for Used Cars More than 5,, CAR LISTINGS SAVE MONEY - with New AI (artificial intelligence) OOYYO SYSTEM. Compare up to three cars using our car comparison tool. Looking for a car but don't know where to start? Look no further! With our easy-to-use find vehicle and comparison tool, quickly find and compare cars that. I put together a simple spreadsheet to compare the price to mileage of cars. It's useful to me since I already know which car I'd like to buy, with only small. Compare SUV, truck, and car prices, mpg, car reviews, specs, rebates & incentives and more. Kelley Blue Book's car comparison tool will help you find the. TrueCar lets you control your car-buying journey. Shop new & used cars, sell your car, and find all the vehicle information you need with our research. Shopping for a new or used car or truck? Download the free r-des.online app and start exploring every possible car for every possible you.

Looking to compare cars? Find the perfect match for your needs with CarMax's car comparison tool. Compare features, prices, and more across trims to make an. Looking for a car but don't know where to start? Look no further! With our easy-to-use find vehicle and comparison tool, quickly find and compare cars that. No-Haggle Pricing. Dealership Store Image. We guarantee you a dealership Search by Location Down Payment Comparison. Privacy Policy Terms of Use. The “Compare Cars” tool from CarWale is designed to help you in car comparison on the basis of prices, mileage, power, performances and hundreds of other. Compare cars, trucks, suvs, and other vehicles on popular vehicle features. Use our tool and start comparing today! Find local trustworthy auto repair professionals. Compare multiple competitive price estimates and book service in a few simple steps. Compare Price & Specs Compiling a wish list for your next new car? Use our compare tool to create your own side by side comparison of up to three models so. The r-des.online app (Android, iOS) is the mobile companion to the popular site and browser extension. You can compare prices at major retailers by typing in a. 13 votes, 11 comments. Hi, I am looking to compare two different cars. I saw a few websites, but they provided incomplete info. The Edmunds app has a tool that helps you compare listings and find the best deal. This tool is based on real market prices. It also has reviews written by. Choose up to four vehicles and compare features, including MSRP, fuel economy, drivetrain specs, crash test results and more, at r-des.online CarWale app is one of the top rated car apps in India for new and used car research. Today, finding a suitable car for your needs can be exhausting. Choose the two vehicles you'd like to compare. Car 1. Make. Compare The Car Part's mission is to make ordering a part as easy as ordering a coffee. Find the cheapest, closest or brand of your choice. Use our new car comparison tool, which allows you to compare the performance, running costs and equipment of up to three cars. Compare vehicles and see how they stack up against each other in terms of rankings, performance, features, specs, safety, prices and more. The CarsDirect Car Comparison Tool lets you create side-by-side comparisons for any combination of vehicles. Save money, enjoy convenient shopping and price comparison, and get the deal you want. Lock up your savings with this better way to buy a car. Compare prices, trims, specs, options, features and scores of up to five cars, trucks or SUVs that are available in Canada with our free side-by-side car. The “Compare Cars” tool from CarWale is designed to help you in car comparison on the basis of prices, mileage, power, performances and hundreds of other.

Fixed Income Annuity With Inflation Protection

Anyone interested in using a chunk of their savings to buy a single premium immediate annuity (SPIA)—that is, an annuity that starts making payments within the. Fixed indexed annuities may also offer alternatives that provide guaranteed lifetime income or a guaranteed death benefit for an additional cost. Income annuity. Fixed annuities don't come with built-in protection against inflation. This can be a major downside given that annuities are generally long-term investments. A fixed annuity is the safest of all annuity types, offering premium protection and the option to set up a stream of income you can never outlive. Fixed. An inflation-protected annuity is generally a “fixed” annuity that includes a component that ratchets up payments each year to account for inflation. Fixed annuities are straightforward and predictable, but their fixed rate offers no protection from inflation and they are less liquid than some alternatives. The premise, born in , contends that retirees can safely withdraw 4% from a balanced stock (50%) and bond (50%) portfolio for 30 years while annually. Your funds are not directly invested in the market, thereby protecting your principal investment in exchange for a capped rate of return. Fixed indexed. Optional features include beneficiary protection or a cost of living adjustment to help keep pace with inflation Stability. Steady, predictable payments. Anyone interested in using a chunk of their savings to buy a single premium immediate annuity (SPIA)—that is, an annuity that starts making payments within the. Fixed indexed annuities may also offer alternatives that provide guaranteed lifetime income or a guaranteed death benefit for an additional cost. Income annuity. Fixed annuities don't come with built-in protection against inflation. This can be a major downside given that annuities are generally long-term investments. A fixed annuity is the safest of all annuity types, offering premium protection and the option to set up a stream of income you can never outlive. Fixed. An inflation-protected annuity is generally a “fixed” annuity that includes a component that ratchets up payments each year to account for inflation. Fixed annuities are straightforward and predictable, but their fixed rate offers no protection from inflation and they are less liquid than some alternatives. The premise, born in , contends that retirees can safely withdraw 4% from a balanced stock (50%) and bond (50%) portfolio for 30 years while annually. Your funds are not directly invested in the market, thereby protecting your principal investment in exchange for a capped rate of return. Fixed indexed. Optional features include beneficiary protection or a cost of living adjustment to help keep pace with inflation Stability. Steady, predictable payments.

Don't forget inflation. Generally speaking, payments from DIAs are not adjusted for inflation, meaning the value of your payout could be eroded over time. You. fixed index annuities: Fixed index occupy a middle-ground between fixed and variable annuities, offering a blend of risk protection and market-based growth. A QLAC is a deferred income annuity that allows you to invest a portion of your retirement portfolio and begin taking income beyond age 73 without conflicting. A deferred annuity is fully indexed as of the most recent date you leave the public service. Your total pension amount is indexed according to the Consumer. IPAs are designed to increase the monthly income payout each year based on a predetermined formula. As we mentioned, the increase is usually tied to changes in. An inflation-adjusted annuity is an annuity contract that provides protection against the negative effect of rising prices for everyday goods and services. Fidelity does have a nice calculator for their fixed annuities, but they don't seem to offer inflation-protected annuities. Their online. You can even ask to have an annual cost-of-living increase built into the calculation as protection against inflation. A fixed income annuity is a safe, secure. A fixed-rate annuity is a type of retirement savings product that grows steadily and safely, providing you with a guaranteed* growth rate and the. Fixed Income Annuities with Inflation Riders There are two types of inflation riders, consumer price index (CPI) and cost-of-living adjustment (C.O.L.A.) Both. No, fixed annuities do not protect against inflation. Fixed annuities provide a fixed rate of return on the individual's investment and do not adjust the income. One type of indexed annuity, registered index-linked annuities (RILAs), sometimes referred to as “buffer annuities,” can feature both upside limits and downside. Opportunity for growth based on positive performance of a market index, and potential protection when index performance is negative. Fixed indexed annuities. Lifetime income from our CREF and Real Estate Account variable annuities is designed to hedge against inflation. Without this stream of retirement income, your. American Pathway® Fixed Annuity · Earn guaranteed interest · Enjoy tax-deferred growth · Protect your income from market risk · Help provide for your family with. Payments are usually payable in fixed dollar amounts, such as $ per month, and do not provide protection against inflation. Some immediate annuities provide. “What you might see is that as inflation rises, equity markets will rise in conjunction with that more rapidly,” Downing says. “A fixed indexed annuity that is. Immediate Annuity Contracts · Payments are usually payable in fixed dollar amounts, such as $ per month, and do not provide protection against inflation. And the interest earned grows tax-deferred. Secure. Protection. An annuity is an insurance product that can help protect you against the risk of outliving your money. It generally comes in two forms: deferred and immediate.